Annual Allowance

One of the benefits of your pension is that it is tax free, up to a certain limit. This limit is known as your annual allowance. We've put together this page to explain the rules and help you understand your options.

Contents

What is your annual allowance?

Your Annual Allowance (AA) is the total amount of pension savings you can make each year before you incur a tax charge.

The standard annual allowance limit is £60,000. This is the maximum amount of money you can build up each year across all your pension schemes – including salary deducted contributions, employer contributions and any additional private pensions you may have (including AVCs, APCs and added pension).

Calculating your annual allowance

Your annual allowance is calculated by working out the change in value of your pension benefits over the year, including any automatic lump sum and additional contributions (if applicable).

- Calculate the annual pension accrued up to the start of the tax year and adjust for inflation using the Consumer Prices Index (CPI).

- Calculate the annual pension accrued at the end of the tax year.

- Subtract the adjusted opening value from the closing value to cover the Pension Input Period (PIP) and multiply by 16.

- Calculate the automatic lump sum accrued up to the start of the tax year and adjust for inflation using the Consumer Prices Index (CPI).

- Calculate the automatic lump sum accrued at the end of the tax year.

- Subtract the adjusted opening value of the automatic lump sum from the closing value to cover the Pension Input Period.

This is the total AVC contributions paid by both you and your employer during the year.

The final figure (after adding together steps 1, 2 and 3) is your total Pension Input Amount (PIA). If your PIA is greater than your £60,000 annual allowance, you may have to pay a tax charge.

Member case studies

26 years scheme membership

Membership up to 31/03/2008 (10 years in 1/80ths final salary scheme)

Membership from 01/04/2008 to 31/03/2014 (6 years in 1/60ths final salary scheme)

Membership in CARE scheme from 01/04/2014

Full time equivalent pay at 05/04/2023 = £45,000

Full time equivalent pay at 05/04/2024 = £60,000

AVC Contributions paid during 2023/24 £2,400

Step 1

Opening pension value:

£5,625 (10 years in 1/80ths final salary scheme)

£4,500 (6 years in 1/60ths final salary scheme)

£7,000 in CARE scheme

Total = £17,125 +10.1% inflation (CPI) = £18,855

Closing pension value:

£7,500 (10 years in 1/80ths final salary scheme)

£6,000 (6 years in 1/60ths final salary scheme)

£8,900 in CARE scheme

Total = £22,400

Closing pension value minus adjusted Opening pension value = £3,545

£3,545 x 16 = £56,720

Step 2

Opening lump sum value:

£16,875 (three times pension accrued in 1/80ths final salary scheme)

Plus 10.1% inflation = £18,579

Closing lump sum value:

£22,500 (three times pension accrued in 1/80ths final salary scheme)

Closing lump sum value minus adjusted Opening lump sum value = £3,921

Step 3

AVC contributions are not included in the opening or closing values in Steps 1 or 2, but are added at the end of the calculation.

AVC contributions paid = £2,400

The increase in the member’s benefits during the Pension Input Period 06/04/2023 to 05/04/2024 is £56,720 + £3,921 + £2,400 = £63,041

This member exceeds the standard Annual Allowance of £60,000 by £3,041

15 years scheme membership

Membership up to 31/03/2014 (5 years 1/60ths final salary scheme)

Membership in CARE scheme from 01/04/2014

Full time equivalent pay 05/04/2023 = £30,000

Full time equivalent pay 05/04/2024 = £40,000

Step 1

Opening pension value:

£2,500 (5 years 1/60ths final salary scheme)

£6,500 in CARE scheme

Total = £9,000

Plus 10.1% inflation (CPI) = £9,909

Closing pension value:

£3,333 (5 years in 1/60ths final salary scheme)

£7,950 in CARE scheme

Total = £11,283

Closing pension value minus adjusted Opening pension value = £1,374

£1,374 x 16 = £21,984

Step 2

This member is not entitled to an automatic lump sum as they were not a member of the scheme before 1 April 2008.

Step 3

This member has not paid any AVCs during the Pension Input Period.

The increase in the member’s benefits during the Pension Input Period 06/04/2023 to 05/04/2024 is £21,984

This member has not exceeded the standard Annual Allowance of £60,000

Carry forward rule

Even if you have exceeded your annual allowance, there’s still a chance you won’t have to pay an annual allowance tax charge. The carry forward rule allows you to include any unused annual allowance from the three previous years towards this year’s allowance (as long as you have been a member of a tax-registered pension scheme in that year).

Tapered annual allowance (for high earners)

While the annual allowance for most people is £60,000, this limit is reduced (tapered) for high earners. So, if your ‘threshold income’ is greater than £200,000 or your ‘adjusted’ income is greater than £260,000, the tax relief available on your pension varies (see table below).

Threshold income = Total Income – pension contributions (including AVCs) – lump sum death benefits from other pension schemes.

Adjusted income = Total income + pension growth (PIA) – any lump sum death benefits.

Tapered annual allowance works on a sliding scale, so the more you earn, the less tax relief you receive (see examples in table below). The minimum tapered annual allowance is £10,000.

| Total adjustable income | Annual allowance |

| £260,000 or below | £60,000 |

| £280,000 | £50,000 |

| £300,000 | £40,000 |

| £320,000 | £30,000 |

| £340,000 | £20,000 |

| £360,000 or more | £10,000 |

Confirming your annual allowance tax charge

To work out whether there’s a tax charge for you to pay, visit the HMRC website where you will find full details of what is and isn’t included.

Unfortunately, as your pension administrators, we are not regulated to offer tax advice, which means we are limited in the support we can provide. If you do need advice on your personal tax situation, you should speak to a professional adviser.

Please be aware

It is your personal responsibility to account for and pay the correct amount of tax in relation to your annual pension savings.

Paying your annual allowance tax

If you receive a letter from us, which includes your annual allowance and Pensions Savings statement, it’s probably because you’re over your annual allowance limit. Please read the contents carefully, as it will outline exactly where you’re up to and what, if anything, you need to pay.

If you do have tax to pay, you have two options:

If your annual allowance charge is less than £2,000, you should pay it directly to HMRC as part of a self-assessment tax return. The deadline for this is 31 January (the following year).

If your annual allowance charge is more than £2,000, we can usually pay some or all of the charges through our Scheme Pays facility. Rather than asking you to pay HMRC directly, we make the payment on your behalf and reduce your pension savings to cover the cost. This works in one of two ways:

This method is available to anyone who meets all three of the following conditions:

- Your LGPS, Police or Fire pension savings for the PIP are more than £60,000.

- Your annual allowance tax charge from your LGPS, Police or Fire Pension Scheme is over £2,000 (or £1,000 in the Police Pension Scheme).

- Your Scheme Pays deduction applies exclusively to your LGPS, Police or Fire scheme.

Important

If you are using mandatory scheme pays, you must let us know by 31 July (following the January when the annual allowance charge was declared on your self-assessment tax return).

For example

If the tax charge was for 2023-2024, you would need to declare the annual allowance tax charge on 31 January 2025 and let us know your decision to use mandatory scheme pays by July 2025.

If you are retiring, transferring out of the scheme, or reach age 75 and have an annual allowance tax charge, you should tell us that you would like to use scheme pays as soon as possible (and before the event has passed) otherwise you will not be eligible.

Anyone who wants to pay their annual allowance charge out of their pension savings, but doesn’t meet the criteria of the Mandatory Scheme Pays, can make an application for Voluntary Scheme Pays. It typically relates to people who are affected by the reduced (tapered) annual allowance.

If you use the Voluntary Scheme Pays facility, you are solely liable for meeting HMRC’s payment deadline of 31 January (the year after the tax charge).

If you wish to use Scheme Pays, you will need to complete a form, which we can provide on request (by completing the online contact form). Just be aware that once you’ve signed and returned this form, you can’t change your mind.

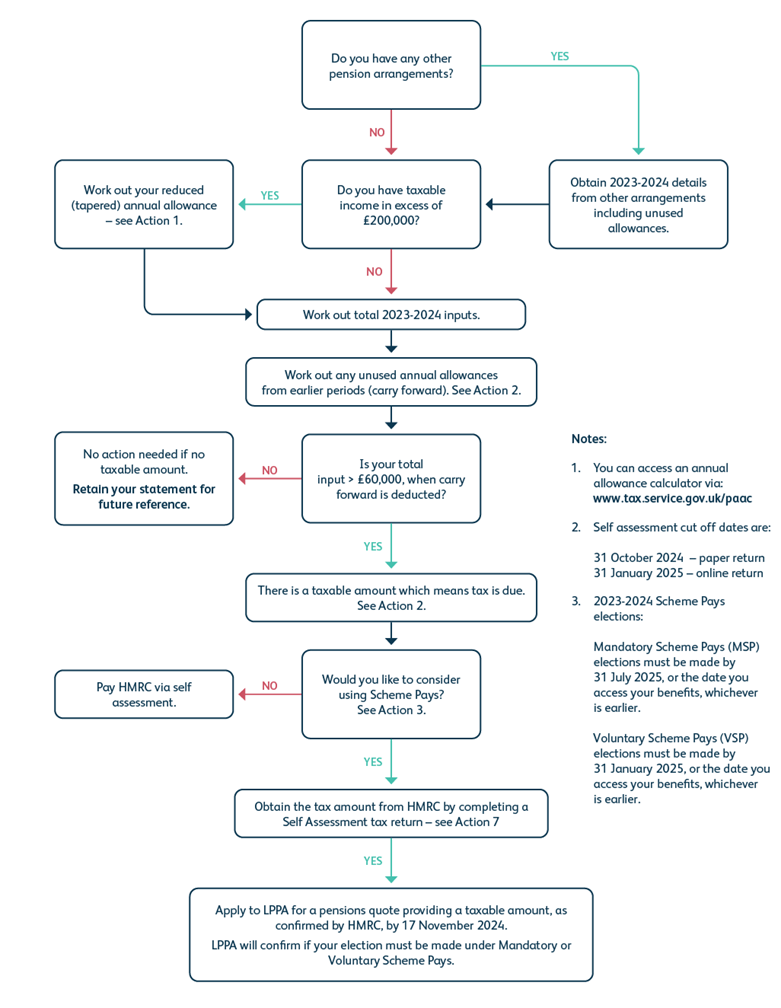

Understanding the annual allowance process

Useful links and additional information

Tax advice

LPPA is not registered to offer financial advice. If you don’t have a financial adviser or a professional tax adviser, websites such as www.unbiased.co.uk may be able to help you find a suitable candidate.

HMRC

You can find additional information about the Annual Allowance on HMRC’s website

The Money and Pensions Service

For independent advice on your pensions, visit the Money & Pensions Service website