Your annual benefit statement

On this page, you'll find everything you need to know about your annual benefit statement (ABS) - including how to access and understand your latest statement.

Contents

What is an annual benefit statement?

Your benefit statement is a summary of your pension benefits for the year up to 31 March. It shows how much your pension is worth at that date and gives you an estimate of what it could be worth when you retire (at your Normal Pension Age).

Your ABS also shows an estimate of any survivor’s pension and death grant entitlements your beneficiaries would receive in the event of your death.

How to access your annual benefit statement

To view your latest ABS, log in to your PensionPoint account and go to My documents > Scheme documents

Not familiar with PensionPoint? Find out moreImportant

Your annual benefit statement should be ready to view in your PensionPoint account by 31 August each year. If, for any reason, it is not available by this date, we will notify you as soon as it has been uploaded.

Please note: all statements dating back to 2020 are available in PensionPoint.

Annual benefit statement (ABS): breakdown

Select your scheme, then open the expandable boxes to view the key things you should check on your statement.

To find out more about the age discrimination remedy and if you are impacted, visit our dedicated remedy page

If you are not eligible for the age discrimination (McCloud) remedy due to your period of service, your annual benefit statement will be available to view as normal in your PensionPoint account by 31 August.

Please read this document carefully as it provides an estimate of your future pension benefits. They key sections to look out for are:

Your current benefits to date

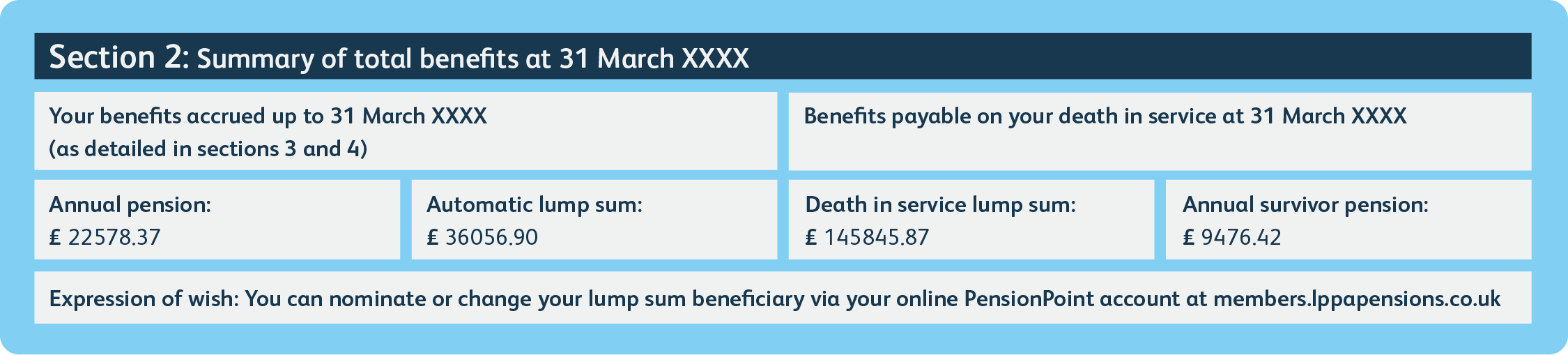

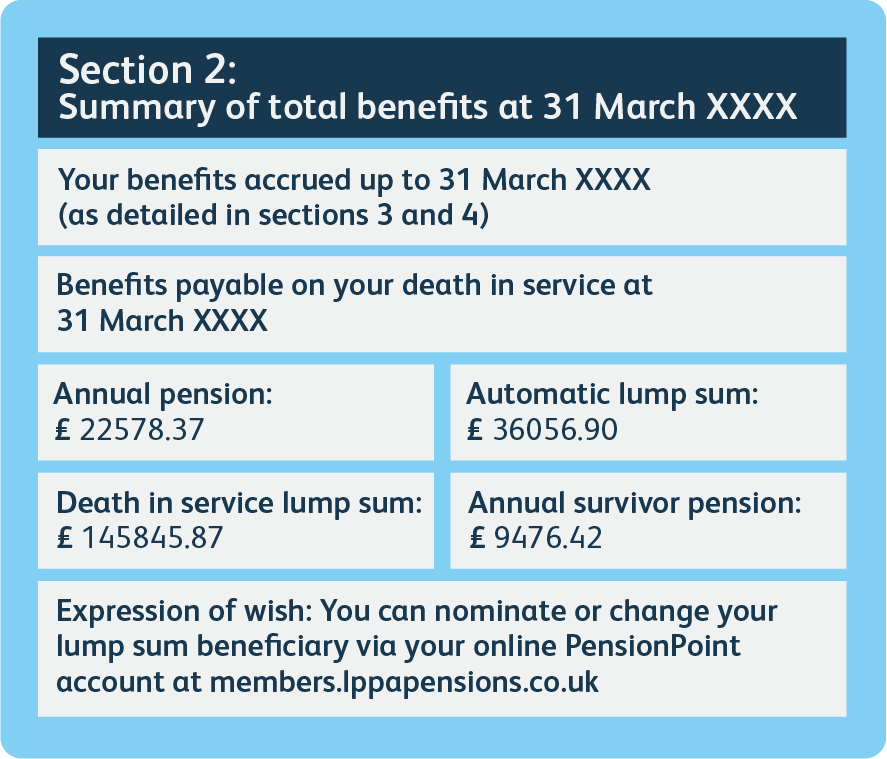

Section 2 of your statement shows how much your pension is currently worth at 31 March. It shows the value of your pension as if you had left the scheme on 31 March.

Annual pension – the total amount of pension you would get each year.

Your estimated future benefits

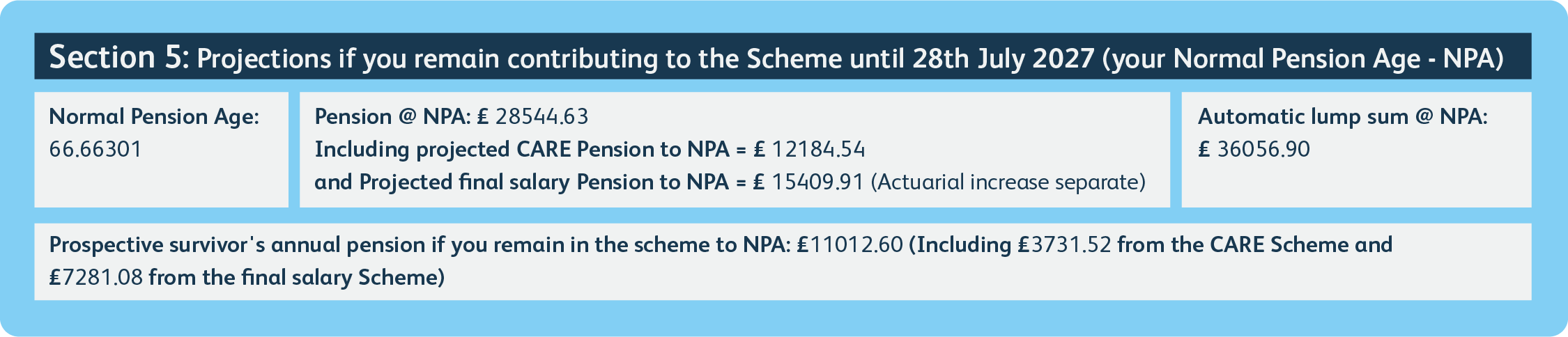

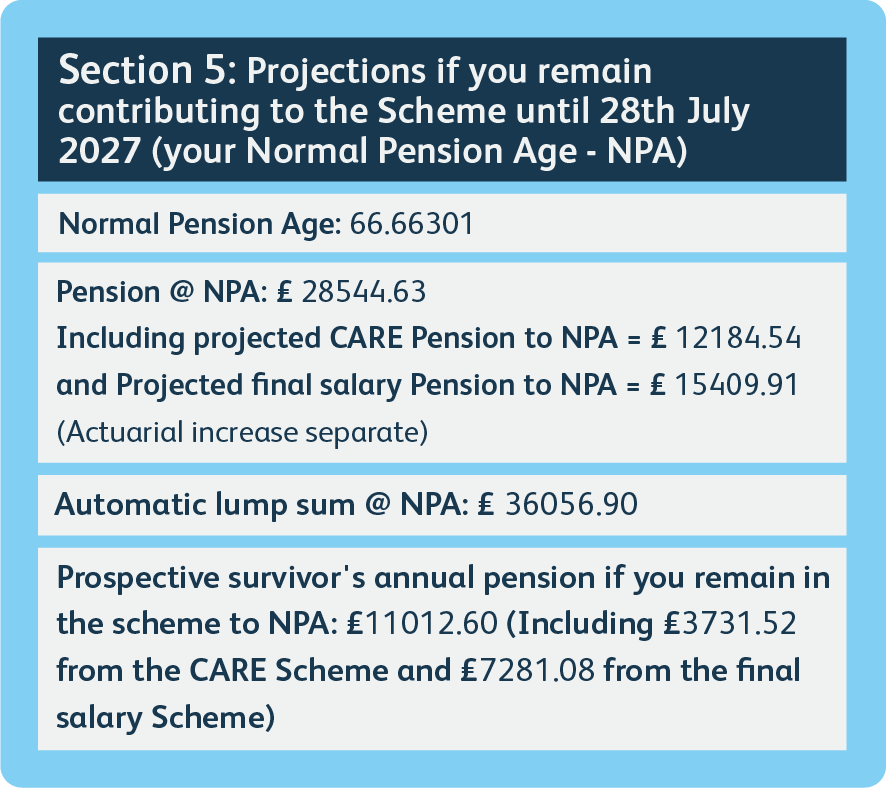

Section 5 of your statement shows how much your pension could be worth at Normal Pension Age (NPA), if you carry on paying into the scheme and stay on the same hours and pay.

Total pension @ NPA – the total amount of pension you’re estimated to get each year.

Maximum lump sum – the maximum tax-free cash lump sum you’re estimated to get.

If you are affected by the age discrimination remedy (McCloud), your ABS will be combined with a remediable service statement (RSS).

How do I access my ABS-RSS?

Your ABS-RSS will be uploaded to PensionPoint by 31 August. Log in to your account and it will be available to view in the My documents section under Scheme documents.

What is included in my ABS-RSS?

It includes benefit estimates for your current FPS scheme and your legacy scheme. It also provides details of your contribution adjustment.

Can I choose my retirement benefits now?

No. The main purpose of your ABS-RSS is to provide you with an up-to-date estimate of your retirement benefit options. You can only decide which set of benefits you wish to take when you retire.

What action do I need to take now?

The only decision to make now (unless you have done so in a previous year) is whether you want to settle your contribution adjustment or leave it until your retirement. If you choose to settle your contribution now, it must be within 12 weeks of receiving your ABS-RSS.

You will have this same option each year (when you receive your ABS-RSS) until you retire.

If you choose to settle your contribution adjustment now, you must complete the remedy contribution adjustment form, which is available on the Forms and Documents page of the LPPA website.

Find more information on contribution adjustments here.

For detailed information on your ABS-RSS, please visit the LGA website.

If you are not eligible for the age discrimination (McCloud) remedy due to your period of service, your annual benefit statement will be available to view as normal in your PensionPoint account by 31 August.

Please read this document carefully as it provides an estimate of your future pension benefits.

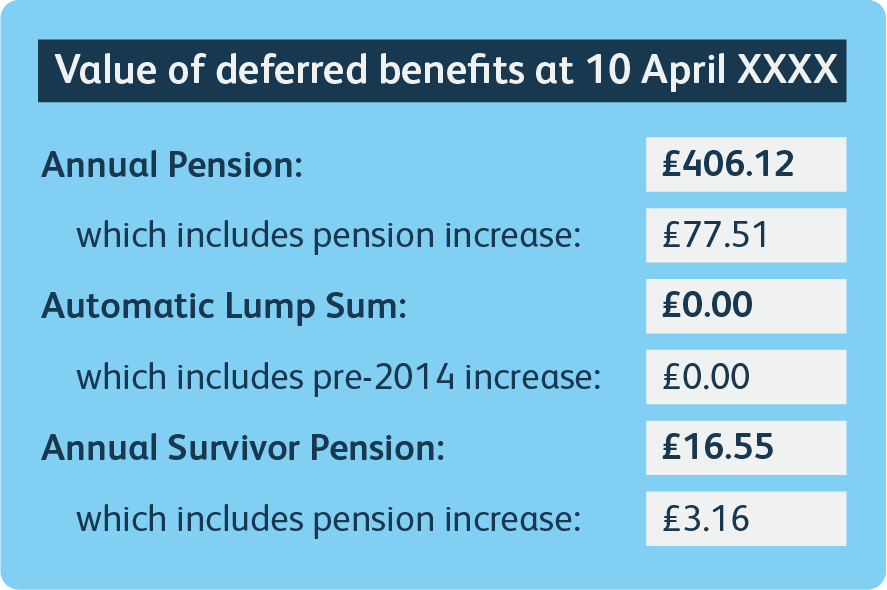

Your current benefits to date

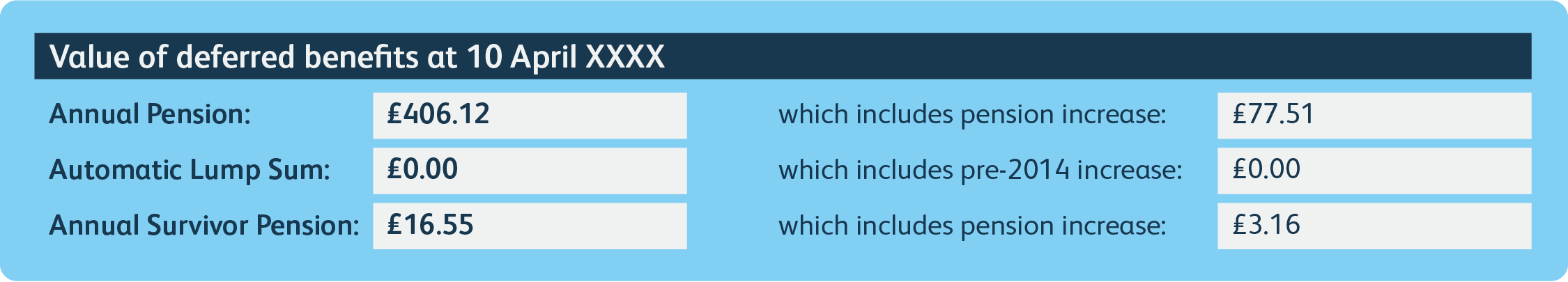

Your statement shows how much your pension is worth if you were to take out your deferred benefits on the date shown. If you have more than one deferred pension with us, you will have separate statements.

Total annual pension – the total amount of pension you would get each year.

If you are affected by the age discrimination remedy (McCloud), your ABS will be combined with a new remediable service statement (RSS).

How do I access my ABS-RSS?

Your ABS-RSS will be uploaded to PensionPoint by 31 August. Log in to your account and it will be available to view in the My documents section under Scheme documents.

What is included in my ABS-RSS?

It includes benefit estimates for your legacy scheme in relation to your membership between 1 April 2015 and 31 March 2022 (known as the remedy period). It also provides details of your contribution adjustment.

Can I choose my retirement benefits now?

No. The main purpose of your ABS-RSS is to provide you with an up-to-date estimate of your retirement benefit options. You can only decide which set of benefits you wish to take when you retire.

What action do I need to take now?

The only decision to make now (unless you have done so in a previous year) is whether you want to settle your contribution adjustment or leave it until your retirement. If you choose to settle your contribution now, it must be within 12 weeks of receiving your ABS-RSS.

You will have this same option each year (when you receive your ABS-RSS) until you retire.

If you choose to settle your contribution adjustment now, you must complete the remedy contribution adjustment form, which is available on the Forms and Documents page of the LPPA website.

Find more information on contribution adjustments here.

For detailed information on your ABS-RSS, please visit the LGA website.

To find out more about the age discrimination remedy and if you are impacted, visit our dedicated remedy page

If you are not eligible for the age discrimination (McCloud) remedy due to your period of service, your annual benefit statement will be available to view as normal in your PensionPoint account by 31 August 2025.

Please read this document carefully as it provides an estimate of your future pension benefits. They key sections to look out for are:

Your current benefits to date

Section 2 of your statement shows how much your pension is worth at 31 March. It shows the value of your pension as if you had left the scheme on 31 March.

Annual pension – the total amount of pension you would get each year.

Your estimated future benefits

Section 5 of your statement shows how much your pension could be worth at Normal Pension Age (NPA), if you carry on paying into the scheme and stay on the same hours and pay.

Total pension @ NPA – the total amount of pension you’re estimated to get each year.

Maximum lump sum – the maximum tax-free cash lump sum you’re estimated to get.

If you are affected by the age discrimination remedy (McCloud), your ABS will be combined with a new remediable service statement (RSS).

How do I access my ABS-RSS?

Your ABS-RSS will be uploaded to PensionPoint by 31 August 2025. Log in to your account and it will be available to view in the My documents section under Scheme documents.

What is included in my ABS-RSS?

It includes benefit estimates for your current PPS scheme and your legacy scheme. It also provides details of your contribution adjustment.

Can I choose my retirement benefits now?

No. The main purpose of your ABS-RSS is to provide you with an up-to-date estimate of your retirement benefit options. You can only decide which set of benefits you wish to take when you retire.

What action do I need to take now?

The only decision to make now (unless you have done so in a previous year) is whether you want to settle your contribution adjustment or leave it until your retirement. If you choose to settle your contribution now, it must be within 12 weeks of receiving your ABS-RSS.

You will have this same option each year (when you receive your ABS-RSS) until you retire.

If you choose to settle your contribution adjustment now, you must complete the remedy contribution adjustment form, which is available on the Forms and Documents page of the LPPA website.

Useful links

For more help understanding your ABS-RSS and your options, visit the NPCC website. You’ll find useful information including:

If you are not eligible for the age discrimination (McCloud) remedy due to your period of service, your annual benefit statement will be available to view as normal in your PensionPoint account by 31 August 2025.

Please read this document carefully as it provides an estimate of your future pension benefits.

Your current benefits to date

Your statement shows how much your pension is worth if you were to take out your deferred benefits on the date shown. If you have more than one deferred pension with us, you will have separate statements.

Total annual pension – the total amount of pension you would get each year.

If you are affected by the age discrimination remedy (McCloud), your ABS will be combined with a new remediable service statement (RSS).

How do I access my ABS-RSS?

Your ABS-RSS will be uploaded to PensionPoint by 31 August 2025. Log in to your account and it will be available to view in the My documents section under Scheme documents.

What is included in my ABS-RSS?

It includes benefit estimates your legacy scheme in relation to your membership between 1 April 2015 and 31 March 2022 (known as the remedy period). It also provides details of your contribution adjustment.

Can I choose my retirement benefits now?

No. The main purpose of your ABS-RSS is to provide you with an up-to-date estimate of your retirement benefit options. You can only decide which set of benefits you wish to take when you retire.

What action do I need to take now?

The only decision to make now (unless you have done so in a previous year) is whether you want to settle your contribution adjustment or leave it until your retirement. If you choose to settle your contribution now, it must be within 12 weeks of receiving your ABS-RSS.

You will have this same option each year (when you receive your ABS-RSS) until you retire.

If you choose to settle your contribution adjustment now, you must complete the remedy contribution adjustment form, which is available on the Forms and Documents page of the LPPA website.

Useful links

For more help understanding your ABS-RSS and your options, visit the NPCC website. You’ll find useful information including:

Remember, most of the figures on your statement are estimates only and may be slightly different from your final retirement figures.

ABS glossary

Use the glossary below to help you understand your annual benefit statement.

| 50/50 section | LGPS only | The amount of pension you have built up in the 50/50 section in the last year up to the date on the statement. To calculate your CARE pension, 1/98 of your pensionable pay is put into your pension account each year. |

| Active | When you are currently paying into your pension. | |

| Additional pension bought | The amount of extra pension you have bought by paying additional contributions in the last year up to the date on the statement. If you have an AVC scheme, you will receive a separate statement from your AVC provider. | |

| Annual benefit statement | A summary of your pension benefits for the year up to 31 March. It shows how much your pension is worth at that date and gives you an estimate of what it could be worth when you retire (at your Normal Pension Age). | |

| Annual final salary pension | The amount of final salary pension you would get yearly if you left the scheme on the date on the statement. | |

| Annual pension | The total amount of pension you would get yearly. | |

| Annual survivor pension | The amount of yearly pension your partner will receive for the rest of their life if you die. This figure will show as zero if you are single. | |

| Automatic lump sum | LGPS only | The value of your automatic tax-free cash lump sum, if you were an LGPS member before 31 March 2008. If you joined after 1 April 2008, this figure will show as zero. |

| Automatic lump sum @ NPA | LGPS only | The amount of automatic tax-free cash lump sum you could get at your Normal Pension Age (NPA) if you were an LGPS member before 31 March 2008. If you joined after 1 April 2008, this figure will show as zero. |

| CARE annual pension | The amount of yearly CARE pension you would get if you were to take out your deferred pension on the date on the statement. | |

| CARE divorce debit | The amount of CARE pension reduced from your benefits. | |

| CARE scheme pays debit | The amount of CARE pension reduced from your benefits because of your scheme pays debits. | |

| Career Average Revalued Earnings (CARE) | A new type of pension scheme that was set up in 2014 (or 2015 for Police and Firefighter schemes). CARE pension is the benefits you built up in a CARE scheme. | |

| Closing balance | Firefighters' and Police only | The total amount of CARE pension you currently have in your pension account up to the date on the statement. |

| Closing balance | LGPS only | The total amount of CARE pension you had in your account last year. |

| Date benefits payable from | The date when your deferred pension benefits will be paid to you. | |

| Date FS benefits payable from | Firefighters' only | The date your final salary benefits will be paid to you. This includes any pension benefits you built up before April 2015. |

| Date of leaving (DOL) | The date you left the employment related to this pension or the date you opted out of the scheme. | |

| Death in service lump sum | A one-off lump sum payment of three times your pensionable pay your loved ones will receive, if you die while paying into the scheme. You can choose (and change) who receives this lump sum by nominating a beneficiary in your online PensionPoint account or sending us a nomination form. | |

| Deferred | When you have left your scheme (eg moved jobs) and are no longer paying into your pension but have not started receiving your benefits yet. | |

| Earned pension | The amount of CARE pension you have built up in the last year up to the date on the statement. | |

| Estimated CARE pension | The amount of yearly CARE pension you could get at Normal Pension Age (NPA) if you stay in the scheme earning the same salary as you do now. | |

| Estimated final salary pension | The amount of yearly Final Salary pension you could get at Normal Pension age (NPA) if you stay in the scheme earning the same salary as you do now. This will show as zero if you only built up benefits in the 2015 scheme. | |

| Estimated survivor's yearly pension | The amount of survivor's pension your partner will receive if you die at Normal Pension Age (NPA). This figure will show as zero if you are single. | |

| Final salary annual pension | The amount of yearly final salary pension you would get if you were to take out your deferred pension on the date on the statement. | |

| Final salary pay | Your basic salary from the last year or your full-time equivalent pay from the last year if you’re working part-time. This figure is used to calculate your final salary benefits. If you work term-time, your final salary pay is calculated based on the number of weeks you worked. | |

| Final salary pensionable pay | Your full-time equivalent pay at the date on the statement. | |

| Former employer | The name of your old employer relating to this pension. | |

| FS divorce debit | The amount of final salary pension reduced from your benefits. | |

| FS scheme pays debit | The amount of final salary pension reduced from your benefits because of your scheme pays debits. | |

| In year build up | The amount of CARE pension you have built up in the last year up to the date on the statement. | |

| Increase for the cost of living | Your pension is revalued each year in line with inflation to keep up with the cost of living. | |

| Main section | LGPS only | The amount of pension you have built up by paying the normal contribution rate in the last year up to the date on the statement. To calculate your CARE pension, 1/49 of your pensionable pay is put into your pension account each year. |

| Maximum lump sum | When you retire, you can swap part of your annual pension for a tax-free cash lump sum. This figure is the maximum tax-free cash lump sum you could get at Normal Pension Age (NPA) if you stay in the scheme earning the same salary as you do now. | |

| Normal Pension Age (NPA) | The age you can receive your pension in full (without any reductions). | |

| Opening balance | The total amount of CARE pension you had in your account last year. | |

| Payroll number | The unique reference number our payroll team uses to identify your pension account. If you have more than one deferred pension with LPPA, you will have different reference numbers for each pension. | |

| Payroll reference | LGPS only | The unique reference number our payroll team uses to identify your pension account. If you have more than one deferred pension with LPPA, you will have different reference numbers for each pension. |

| Pension @ NPA | LGPS only | The total amount of yearly pension you could get if you stay in the LGPS earning the same salary as you do now and retire at Normal Pension Age (NPA). This does not include future increases for inflation. |

| Pension debit | The amount that is reduced from your pension benefits because of a pension sharing order or because you chose to pay an annual allowance tax charge using scheme pays. These are estimated figures based on your current earnings and your actual pension debits will be calculated when you retire. If you don't have any debits, this section will show as zero. | |

| Pension reference | The reference number we use to identify your pension account. If you have more than one deferred pension with LPPA, you will have different reference numbers for each pension. | |

| Pensionable pay | The part of your salary used to calculate your pension contributions. Depending on your scheme, it may include your basic salary, bonuses, overtime pay, and certain types of leave pay (like maternity, paternity or adoption). | |

| Projected career average pension to NPA | LGPS only | The amount of yearly CARE pension you could get at Normal Pension Age (NPA) if you stay in the LGPS earning the same salary as you do now. |

| Projected final salary pension to NPA | LGPS only | The amount of yearly Final Salary pension you could get at Normal Pension age (NPA) if you stay in the LGPS earning the same salary as you do now. |

| Prospective survivor's annual pension | The amount of yearly pension your partner will receive for the rest of their life if you die at Normal Pension Age (NPA). This figure will show as zero if you are single. | |

| Protected/protection | A status that safeguards certain pension rights or benefits for eligible members affected by changes in pension rules, when public service pensions were reformed in 2014 and 2015. | |

| Remedy | When public service pensions were reformed in 2014 and 2015, protections were given to older members. In 2018, the Court of Appeal ruled this was discriminatory against younger members. This ruling is known as the McCloud judgment. The changes introduced to fix the discrimination are called the McCloud remedy. | |

| Scheme at DOL | The scheme you were in at your date of leaving (DOL). | |

| Scheme year CARE total | The total amount of CARE pension you have built up in the last year up to the date on the statement. | |

| Total annual pension | The total amount of pension you would get yearly. | |

| Total career average pension | The total amount of CARE pension you have in your pension account at the date on the statement. | |

| Total pension @ NPA | The total amount of yearly pension you could get at Normal Pension Age (NPA) if you stay in the scheme earning the same salary as you do now. | |

| Underpin | LGPS only | When you take your pension at retirement, the benefits payable under the career average scheme are compared with the benefits that would have been built up if the final salary scheme continued – and you’ll receive the higher amount. This protection is called the 'underpin'. |

| Transfers in | The amount of pension you have transferred into your account in the last year up to the date on the statement. |