Your annual benefit statement (ABS)

Everything you need to know about your annual benefit statement including a section-by-section guide.

Contents

If you can’t see your latest statement in PensionPoint, we may still need to process and upload your ABS. Please check again later or contact us.

You can only view your annual benefit statements from the last three years. If yours is missing please contact us.

Remember, most of the figures on your statement are estimates only and may be slightly different from your final retirement figures.

For Police and Firefighter members, this statement does not include reinstatement of the benefits you received between 2015 to 2022 from the CARE scheme to your old scheme as part of the McCloud remedy.

Annual Benefit Statement breakdowns (active members)

If you’re still paying into your pension scheme, use the expandable boxes below to get a step-by-step breakdown of your annual benefit statement.

Local Government (Active)

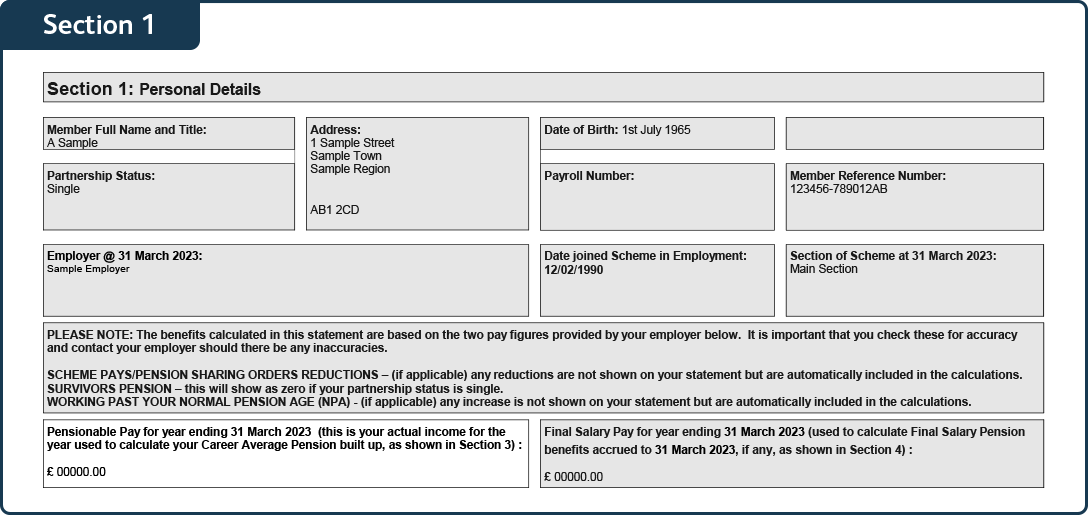

Section 1 shows your personal details given to us by your employer on 31 March 2023.

If your name or address is incorrect or has since changed, you can easily update them in PensionPoint. If any other personal details are incorrect, please contact your employer who can update them for you.

These details were provided by your employer on 31 March 2023. So, if you’ve made a change since that date, it will not show on this statement.

Pensionable pay – this is the portion of your salary used to calculate how much your pension contributions are each year. This may include your basic salary plus any bonuses and overtime payments.

Final salary pay – before April 2014, the LGPS (Local Government Pension Scheme) was a final salary pension scheme. This meant that your benefits were based on the pay you earned at the end of your membership. If you paid into the scheme before April 2014, you have built up benefits in the final salary scheme.

Final salary pay* is your basic salary from the last year or your full-time equivalent pay from the last year if you’re working part-time. This figure is used to calculate your final salary benefits.

*If you are a Cumbria or Bexley member who works term-time, your final salary pay is calculated differently, based on the number of weeks you worked.

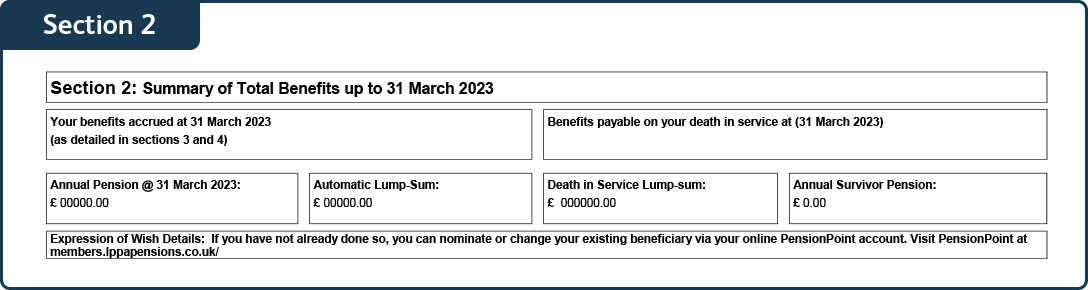

Section 2 shows a summary of the total pension benefits you have built up since joining the scheme up to 31 March 2023. It shows the value of your pension as if you had left the scheme on 31 March 2023.

Annual pension – this is the total amount of pension you would get yearly (including final salary and CARE pension).

Automatic lump sum – this is the value of your automatic tax-free cash lump sum, if you were a member of the LGPS before 31 March 2008.

If you became a member of the LGPS after 1 April 2008, you will not have built up an automatic lump sum and this figure will show as zero. However, you will have the option to swap part of your annual pension for a tax-free cash lump sum when you retire.

Death in service lump sum – as a member of the LGPS, a lump sum payment of three times your pensionable pay (at your date of death) is paid to your loved ones.

You can choose (and change) who receives this lump sum by nominating a beneficiary in your online PensionPoint account.

Annual survivor pension – this is the amount of yearly pension your spouse, civil partner or eligible cohabiting partner will get after you die, which will be paid for the rest of their life.

Please note – this figure will show as zero, if your partnership status is single in section 1.

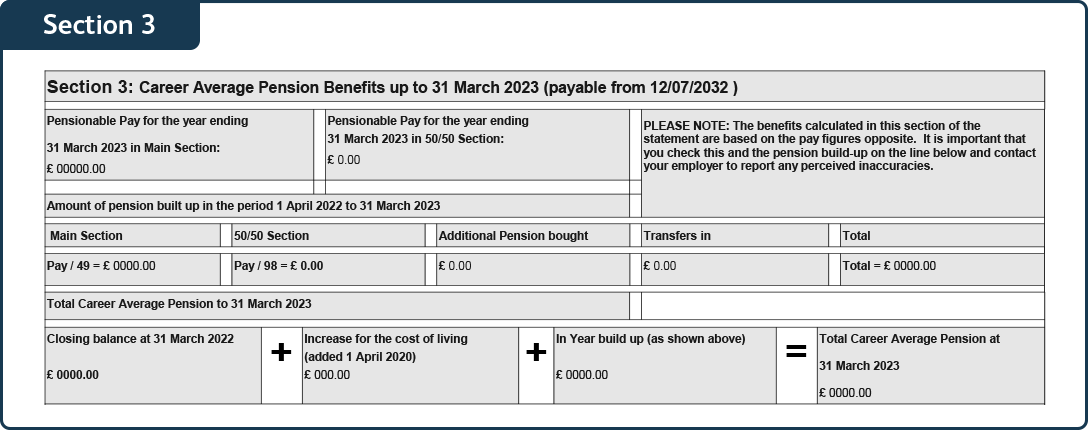

Section 3 shows the Career Average Pension (CARE) benefits you have built up to 31 March 2023. From 2014, the LGPS changed from a final salary to a Career Average Revalued Earnings (CARE) scheme, which uses a different calculation to work out how much pension you have built up.

Pensionable pay – this is the portion of your salary used to calculate how much your pension contributions are each year. This may include your basic salary plus any bonuses and overtime payments.

Main section – this is the amount of pension you have built up by paying the normal contribution rate in the last year up to 31 March 2023. To calculate your CARE pension, 1/49 of your pensionable pay is put into your pension account each year.

As an LGPS member, you also have the option of reducing your contributions by switching to the 50/50 scheme. This allows you to pay half the contributions you would do in the full scheme for half of the benefits. Learn more here.

50/50 section – this is the amount of pension you have built up in the 50/50 section of the LGPS scheme in the last year up to 31 March 2023. In the 50/50 section, you pay half your normal contribution rate and build up half your normal pension. To calculate your CARE pension, 1/98 of your pensionable pay is put into your pension account each year.

Additional pension bought – this is the amount of extra pension you have bought in the last year up to 31 March 2023, by paying additional pension contributions (APC). If you bought additional voluntary contributions (AVC), you will receive a separate statement for your AVC provider.

If you’re interested in boosting your pension to save more money for retirement, find out more here.

Transfers in – this is the amount of pension you have transferred into this account in the last year from a previous pension account. Learn more about transferring in your pension.

Closing balance – this is the total amount of CARE pension you had in your account from last year at 31 March 2022.

In year build up – this is the amount of CARE pension you have built up in the last year up to 31 March 2023 (which is the same figure shown under ‘Total’).

Increase for the cost of living – your pension is revalued each year in line with inflation to keep up with the cost of living.

Total career average pension – this is the total amount of CARE pension you have in your pension account at 31 March 2023.

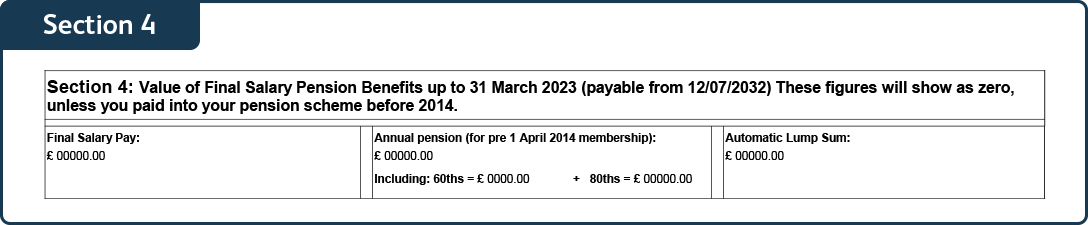

Section 4 shows the final salary benefits you have built up to 31 March 2023. From 2014, the LGPS changed from a final salary to a Career Average Revalued Earnings (CARE) scheme. If you joined the LGPS before 2014, you have built up benefits in the final salary scheme, which uses a different calculation to work out how much pension you have built up.

This section shows the value of your final salary pension as if you had left the scheme on 31 March 2023.

Final salary pay – this is the basic salary you earned (or your full-time equivalent if you’re working part-time), from 1 April 2022 to 31 March 2023.

Annual pension – this is the amount of final salary pension you would get yearly. Two different calculations are used depending on when you paid into the scheme.

For any pension built up between 1 April 2008 and 31 March 2014, 1/60 of your final pay is used to calculate your pension. For any pension built up before 1 April 2008, 1/80 of your final pay is used to calculate your pension.

Automatic lump sum – this is the value of your automatic tax-free cash lump sum, if you were a member of the LGPS before 31 March 2008.

If you became a member of the LGPS after 1 April 2008, you have not built up an automatic lump sum and this figure will show as zero. However, you will have the option to swap part of your annual pension for a tax-free cash lump sum when you retire.

Section 5 shows the amount of pension you are estimated to get if you continue to pay into the scheme until your Normal Pension Age (NPA). The figures include this year’s cost of living (inflation) increase but not future cost of living increases.

Normal Pension Age – this is the age you can receive your pension in full under the scheme rules (without any reductions), based on the State Pension Age.

Pension @ NPA – this is the total amount of pension you’re projected to get yearly if you stay in the LGPS earning the same salary as you do now and retire at your Normal Pension Age (NPA).

Projected career average pension to NPA – this is the amount of yearly CARE pension you are estimated to get at Normal Pension Age (NPA), if you continue to earn the same salary as you do now.

Projected final salary pension to NPA – this is the amount of yearly Final Salary pension you are estimated to get at Normal Pension Age (NPA), if you continue to earn the same salary as you do now.

Your actual final salary benefits will be based on your salary when you leave the scheme.

Automatic lump sum @ NPA – this is the value of your automatic tax-free cash lump sum, if you were a member of the LGPS before 31 March 2008. The figure shown is the amount of lump sum you are estimated to get at your Normal Pension Age (NPA).

If you became a member of the LGPS after 1 April 2008, you will not have built up an automatic lump sum and this figure will show as zero. However, you will have the option to swap part of your annual pension for a tax-free cash lump sum when you retire.

Prospective survivor’s annual pension – this is the amount of survivor’s pension your partner is estimated to get in the event of your death at Normal Pension Age (NPA). This includes your spouse, civil partner or an eligible cohabiting partner.

Please note – this figure will show as zero, if your partnership status is single in section 1.

Police (Active)

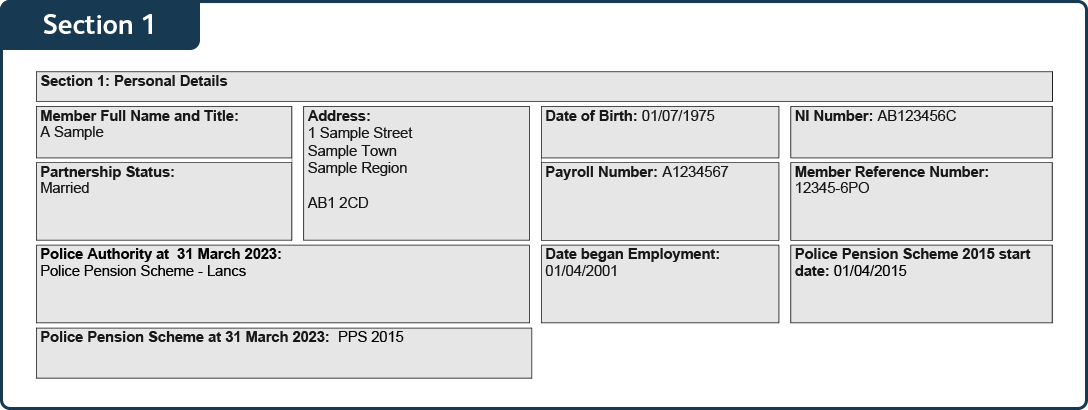

Section 1 shows your personal details given to us by your employer on 31 March 2023. If your name or address is incorrect or has since changed, you can easily update them in PensionPoint. If any other personal details are incorrect, please contact your employer who can update them for you.

These details were given by your employer on 31 March 2023. So, if you’ve made a change since that date, it will not show on this statement.

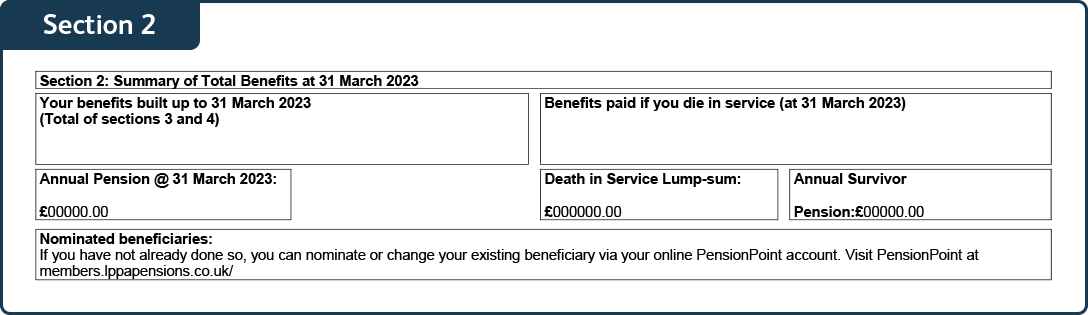

Section 2 shows a summary of the total pension benefits you have built up since joining the scheme to 31 March 2023. It shows the value of your pension as if you had left the scheme on 31 March 2023.

Annual pension – this is the total amount of pension you would get yearly if you left the scheme on 31 March 2023.

Death in service lump sum – if you die in service as a member of the Police Pension Scheme, a lump sum payment of three times your pensionable pay (at the date of your death) is automatically paid to your spouse, civil partner or declared partner.

The figure shown is the amount of lump sum they would get as if you had died on 31 March 2023.

If you do not have a spouse, civil partner or declared partner, you can choose who will receive the lump sum by nominating a beneficiary in your online PensionPoint account or filling in a declaration form here.

Annual survivor pension – this is the amount of yearly pension your spouse, civil partner or declared partner will get (as if you had died on 31 March 2023), which will be paid for the rest of their life.

Please note – this figure will show as zero, if your partnership status is single in section 1.

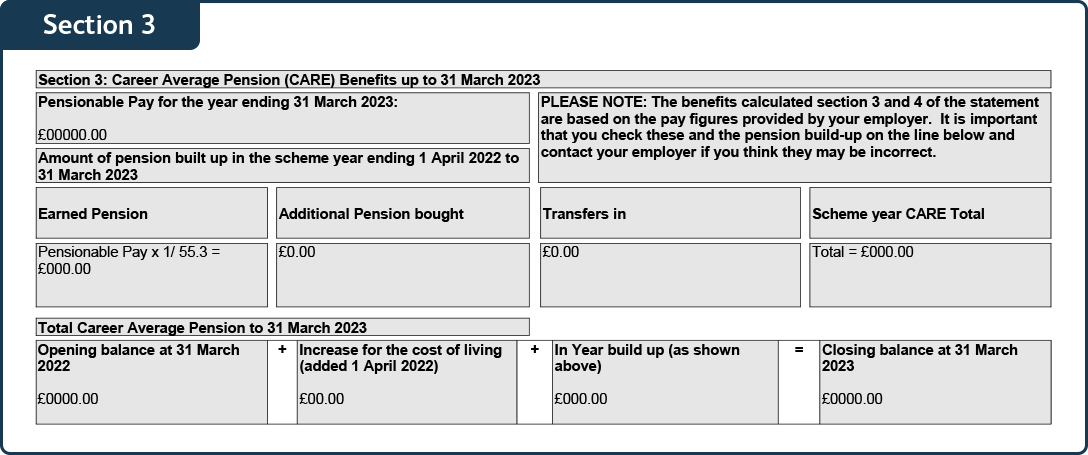

Section 3 shows the Career Average Pension (CARE) benefits you have built up to 31 March 2023. From 2015, the Police Pension Scheme changed from a final salary to a Career Average Revalued Earnings (CARE) scheme, which uses a different calculation to work out how much pension you have built up.

Pensionable pay – this is the portion of your salary used to calculate how much your pension contributions are each year.

Earned pension – this is the amount of CARE pension you have built up in the last year up to 31 March 2023. To calculate your CARE pension, 1/55.3 of your pensionable pay is put into your pension account each year.

If you’re interested in boosting your pension to save more money for retirement, find out more here.

Additional pension bought – this is the amount of extra pension you have bought in the last year up to 31 March 2023 by paying added pension contributions.

Transfers in – this is the amount of pension you have transferred into this account in the last year up to 31 March 2023 from a previous pension account. Learn more about transferring in your pension.

Scheme year CARE total – this is the total amount of CARE pension you have built up in the last year up to 31 March 2023.

Opening balance – this is the total amount of CARE pension you had in your account from last year at 31 March 2022.

In year build up – this is the total amount of CARE pension you have built up in the last year up to 31 March 2023 (which is the same figure shown in ‘Scheme year CARE total’).

Increase for the cost of living – your pension is revalued each year in line with inflation to keep up with the cost of living, so that your pension is worth more in the future.

Please note – this year’s cost of living increase has not been included in these calculations.

Closing balance – this is the total amount of CARE pension you currently have in your pension account up to 31 March 2023.

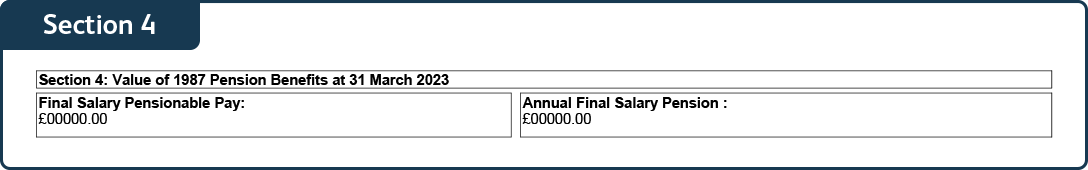

Section 4 shows the final salary benefits you would get if you left the scheme on 31 March 2023. From 2015, the Police Pension Scheme changed from a final salary to a Career Average Revalued Earnings (CARE) scheme.

If you were a member of the 1987 or 2006 schemes before April 2015, you have built up benefits in a final salary scheme, which uses a different calculation to work out how much pension you have built up.

Final salary pensionable pay – this is your full-time equivalent pay at 31 March 2023.

Annual final salary pension – this is the amount of final salary pension you would get yearly if you left the scheme on 31 March 2023.

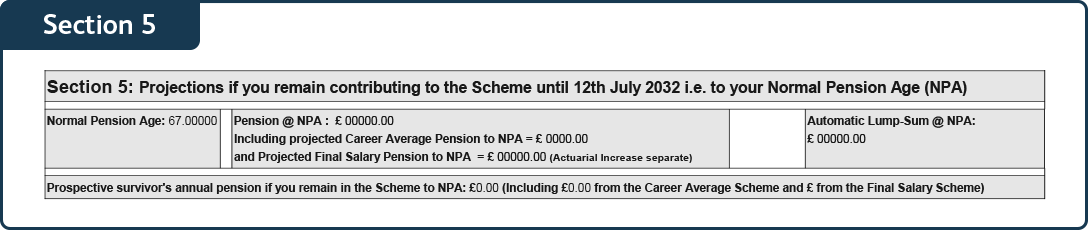

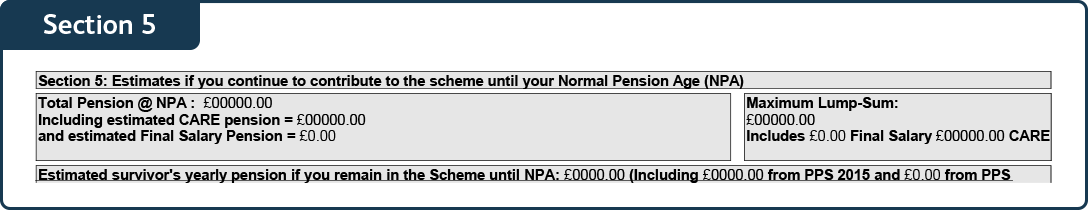

Section 5 shows the amount of pension you’re estimated to get if you continue to pay into the scheme until your Normal Pension Age (NPA) and earn the same salary as you do now. NPA is the age you can receive your pension in full under the scheme rules (without any reductions), based on the State Pension Age.

The figures include this year’s cost of living (inflation) increase but not future cost of living increases.

Total pension @ NPA – this is the total amount of pension you’re estimated to get yearly if you stay in the Police Pension Scheme earning the same salary as you do now and retire at your Normal Pension age (NPA).

Estimated CARE pension – this is the amount of CARE pension you’re estimated to get yearly if you stay in the 2015 Police Pension Scheme earning the same salary as you do now and retire at Normal Pension Age (NPA).

Estimated final salary pension – this is the amount of final salary pension you’re estimated to get yearly, if you stay in the Police Pension Scheme, earning the same salary as you do now and retire at your Normal Pension Age (NPA).

This will show as zero if you have not built up pension benefits in the 1987 or 2006 schemes.

Maximum lump sum – when you retire, you can swap part of your annual pension for a tax-free cash lump sum. This figure is the maximum tax-free cash lump sum you’re estimated to get if you stay in the 2015 Police Pension Scheme earning the same salary as you do now and retire at Normal Pension Age (NPA).

Estimated survivor’s yearly pension – this is the amount of survivor’s pension your partner is estimated to get in the event of your death at Normal Pension Age (NPA). This includes your spouse, civil partner or declared partner.

This figure includes the survivor’s benefits from your 2015 and your old (1987/2006) police pensions.

Please note – this figure will show as zero, if your partnership status is single in section 1.

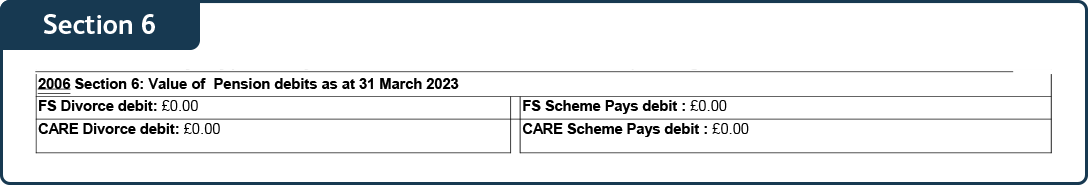

Section 6 shows the estimated value of your pension debits at 31 March 2023. This section will only apply to you if you have a pension sharing order after a divorce/dissolution of a civil partnership or if you have scheme pays debits.

A pension debit is the amount that is reduced from your pension benefits because of a pension sharing order or because you chose to pay an annual allowance tax charge using scheme pays. These are estimated figures based on your current earnings and your actual pension debits will be calculated when you retire.

Please note – this section will show as zero if you do not have any pension debits or scheme pays debits.

FS divorce debit – this is the amount of final salary pension that will be reduced.

CARE divorce debit – this is the amount of Career Average Revalued Earnings (CARE) pension that will be reduced.

FS scheme pays debit – this is the amount of final salary pension that will be reduced, because of your scheme pays debits.

CARE scheme pays debit – this is the amount of Career Average Revalued Earnings (CARE) pension that will be reduced, because of your scheme pays debits.

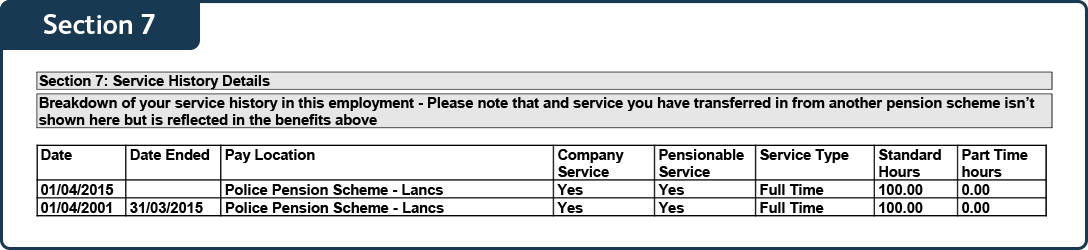

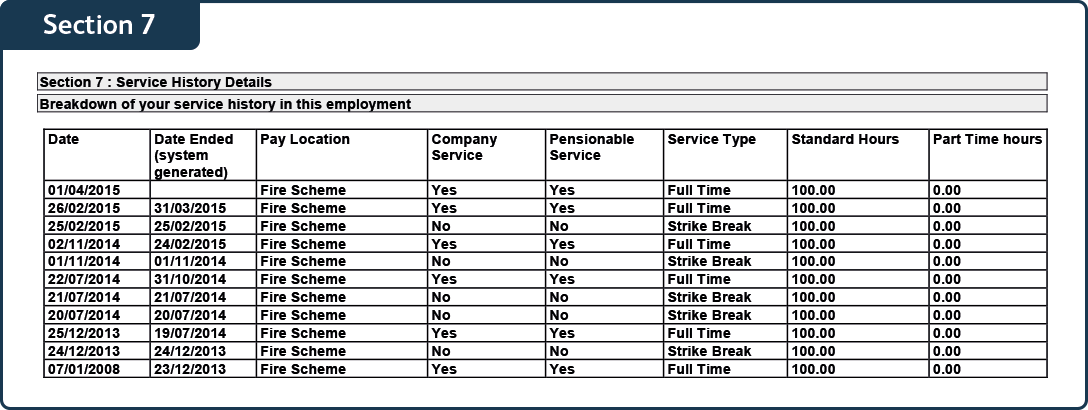

Section 7 gives you a breakdown of your work history with your employer.

Please note – it may not be possible to show a full-service history on this statement.

Firefighters (Active)

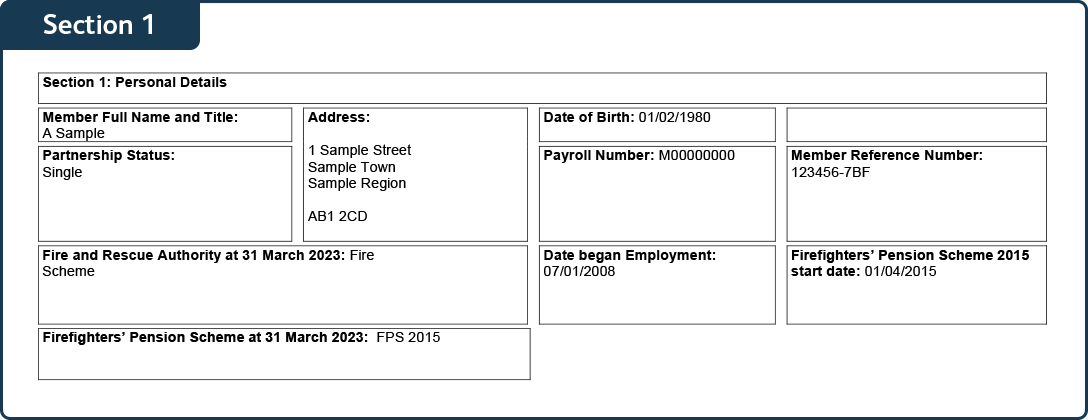

Section 1 shows your personal details given to us by your employer on 31 March 2023. If your name or address is incorrect or has since changed, you can easily update them in PensionPoint. If any other personal details are incorrect, please contact your employer who can update them for you.

These details were given by your employer on 31 March 2023. So, if you’ve made a change since that date, it will not show on this statement.

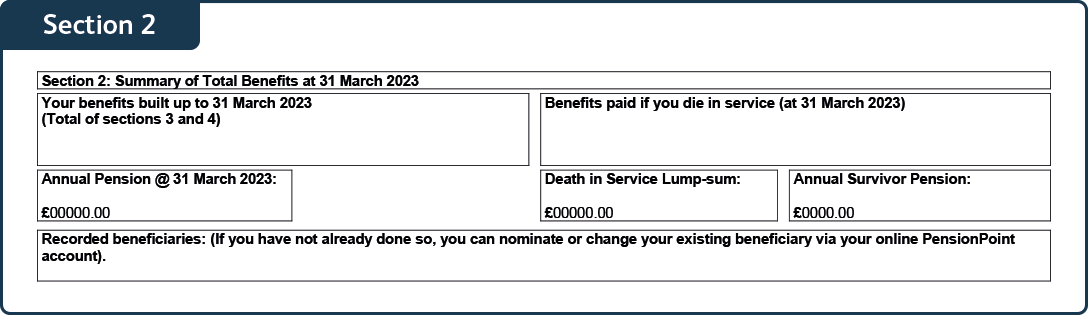

Section 2 shows a summary of the total pension benefits you have built up since joining the scheme up to 31 March 2023. It shows the value of your pension as if you had left the scheme on 31 March 2023.

Annual pension – this is the total amount of pension you would get yearly if you left the scheme on March 2023.

Death in service lump sum – if you die in service as a member of the Firefighters’ Pension Scheme, a lump sum payment of three times your pensionable pay (at the date of your death) is paid to your loved ones.

This figure shown is the amount of lump sum they would get as if you had died on 31 March 2023.

You can choose who receives this lump sum by nominating a beneficiary in your online PensionPoint account.

Annual survivor pension – this is the amount of yearly pension your spouse, civil partner or eligible cohabiting partner will get (as if you had died on 31 March 2023), which will be paid for the rest of their life.

Please note – this figure will show as zero, if your partnership status is single in section 1.

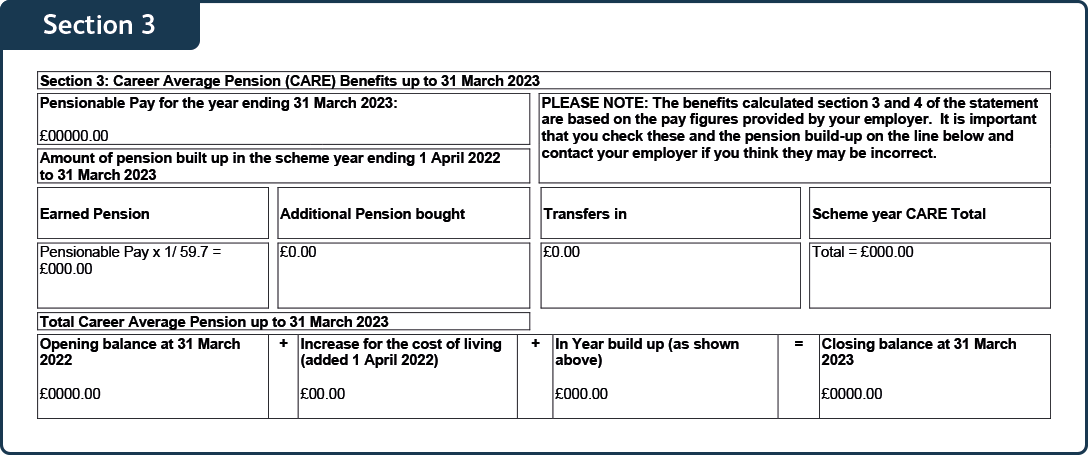

Section 3 shows the Career Average Pension (CARE) benefits you have built up to 31 March 2023. From 2015, the Firefighters’ Pension Scheme changed from a final salary to a Career Average Revalued Earnings (CARE) scheme, which uses a different calculation to work out how much pension you have built up.

Pensionable pay – this is the portion of your salary used to calculate how much your pension contributions are each year.

Earned pension – this is the amount of CARE pension you have built up in the last year up to 31 March 2023. To calculate your CARE pension, 1/59.7 of your pensionable pay is put into your pension account each year.

If you’re interested in boosting your pension to save more money for retirement, find out more here.

Additional pension bought – this is the amount of extra pension you have bought in the last year up to 31 March 2023, by paying added pension contributions.

Transfers in – this is the amount of pension you have transferred into this account in the last year up to 31 March 2023 from a previous pension account. Learn more about transferring in your pension.

Scheme year CARE total – this is the total amount of CARE pension you have built up in the last year up to 31 March 2023.

Opening balance – this is the total amount of CARE pension you had in your account from last year at 31 March 2022.

In year build up – this is the total amount of CARE pension you have built up in the last year up to 31 March 2023 (which is the same figure shown in ‘Scheme year CARE total’).

Increase for the cost of living – your pension is revalued each year in line with inflation to keep up with the cost of living, so that your pension is worth more in the future.

Please note – this year’s cost of living increase has not been included in these calculations.

Closing balance – this is the total amount of CARE pension you currently have in your pension account up to 31 March 2023.

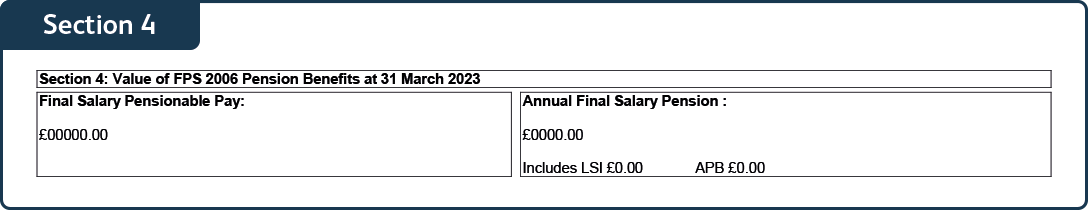

Section 4 shows the final salary benefits you would get if you left the scheme on 31 March 2023. From 2015, the Firefighters’ Pension Scheme changed from a final salary to a Career Average Revalued Earnings (CARE) scheme.

If you were a member of the 1992 or 2006 schemes before April 2015, you have built up benefits in a final salary scheme, which uses a different calculation to work out how much pension you have built up.

Final salary pensionable pay – this is your full-time equivalent pay at 31 March 2023.

Annual final salary pension – this is the amount of final salary pension you would get yearly if you left the scheme on 31 March 2023.

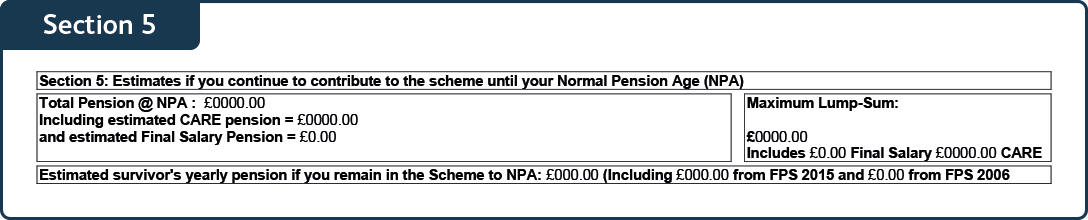

Section 5 shows the amount of pension you’re estimated to get if you continue to pay into the scheme until your Normal Pension Age (NPA) and earn the same salary as you do now. NPA is the age you can receive your pension in full under the scheme rules (without any reductions), based on the State Pension Age.

The figures include this year’s cost of living (inflation) increase but not future cost of living increases.

Total pension @ NPA – this is the total amount of pension you’re estimated to get yearly if you stay in the Firefighters’ Pension Scheme earning the same salary as you do now and retire at your Normal Pension age (NPA).

Estimated CARE pension – this is the amount of CARE pension you’re estimated to get yearly if you stay in the 2015 Firefighters’ Pension Scheme earning the same salary as you do now and retire at Normal Pension Age (NPA).

Estimated final salary pension – this is the amount of final salary pension you’re estimated to get yearly, if you stay in the Firefighters’ Pension Scheme, earning the same salary as you do now and retire at your Normal Pension Age (NPA).

This will show as zero if you have not built up pension benefits in the 1992 or 2006 schemes.

Maximum lump sum – when you retire, you can swap part of your annual pension for a tax-free cash lump sum. This figure is the maximum tax-free cash lump sum you’re estimated to get if you stay in the 2015 Firefighters’ Pension Scheme earning the same salary as you do now and retire at Normal Pension Age (NPA).

Estimated survivor’s yearly pension – this is the amount of survivor’s pension your partner is estimated to get in the event of your death at Normal Pension Age (NPA). This includes your spouse, civil partner or an eligible cohabiting partner.

This figure includes the survivor’s benefits from your 2015 pension and your old (1992/2006) pensions.

Please note – this figure will show as zero, if your partnership status is single in section 1.

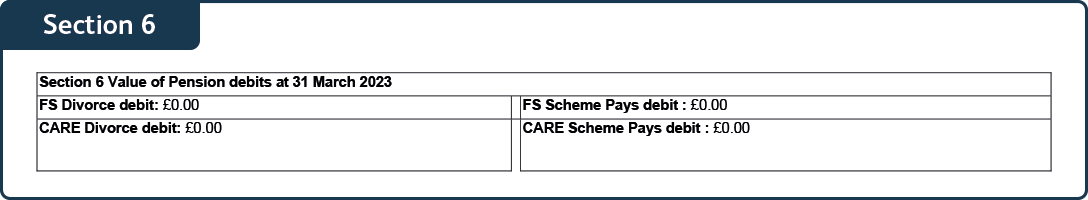

Section 6 shows the estimated value of your pension debits at 31 March 2023. This section will only apply to you if you have a pension sharing order after a divorce/dissolution of a civil partnership or if you have scheme pays debits.

A pension debit is the amount that is reduced from your pension benefits because of a pension sharing order or because you chose to pay an annual allowance tax charge using scheme pays. These are estimated figures based on your current earnings and your actual pension debits will be calculated when you retire.

Please note – this section will show as zero if you do not have any pension debits or scheme pays debits.

FS divorce debit – this is the amount of final salary pension that will be reduced.

CARE divorce debit – this is the amount of Career Average Revalued Earnings (CARE) pension that will be reduced.

FS scheme pays debit – this is the amount of final salary pension that will be reduced, because of your scheme pays debits.

CARE scheme pays debit – this is the amount of Career Average Revalued Earnings (CARE) pension that will be reduced, because of your scheme pays debits.

Section 7 gives you a breakdown of your work history with your employer.

Please note – it may not be possible to show a full-service history on this statement.

Local Government, Police & Firefighters (deferred members)

What is a deferred pension?

It’s a pension that you are no longer paying into but have not started receiving payments for yet.

What is a deferred member?

It’s a member who has stopped paying into their pension scheme (such as moved jobs) and is no longer contributing to their pension.

Your annual benefit statement shows the value of your pension benefits up to 10 April 2023. If you have more than one deferred pension with us, you will have separate statements for each.

Please note – your annual benefit statements will be slightly different if you have a pension credit/deferred statement because of a pension sharing order.

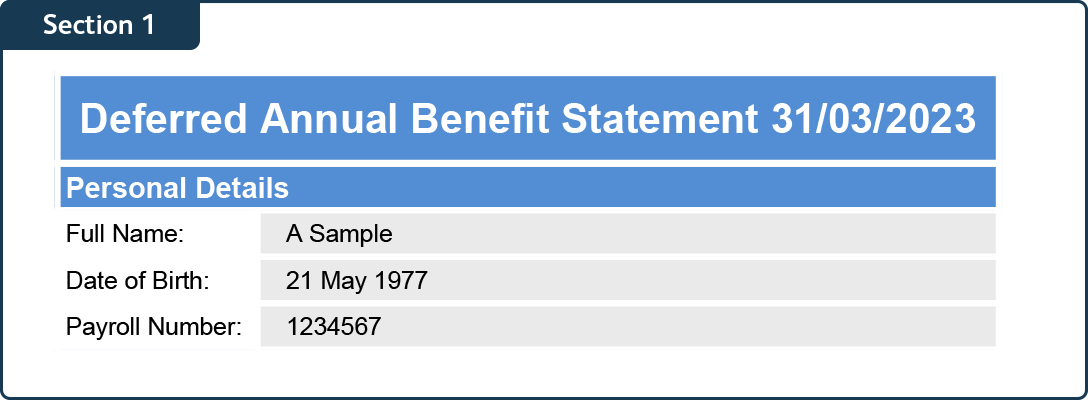

Section 1: For all members

Section 1 shows your personal details at 10 April 2023. If your name or address is incorrect or has since changed, you can easily update them in PensionPoint. If any other personal details are incorrect, please contact us so we can update them for you.

Remember – these are the details we held for you at 10 April 2023. So, if you’ve made a change since that date, it will not show on this statement.

Fire and Police members only:

Payroll number – this is the unique reference number our payroll team uses to identify your pension account. If you have more than one deferred pension with us, you will have different reference numbers for each pension.

Section 2:

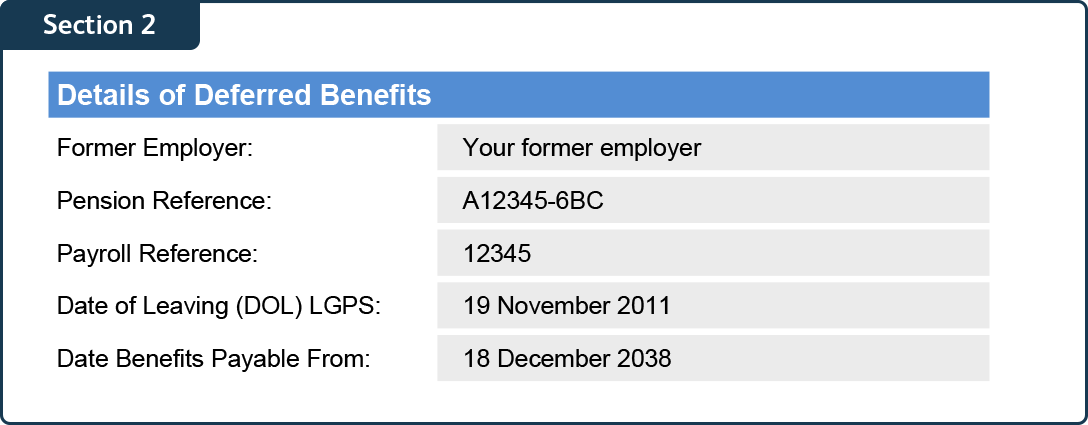

For Local Government members

Section 2 section shows any details relating to your deferred pension.

Former employer – this is the name of your old employer, relating to this pension.

Pension reference – this is the reference number we use to identify your pension account. If you have more than one deferred LGPS pension with us, you will have different reference numbers for each pension.

Payroll reference – this is the unique reference number our payroll team uses to identify your pension account. If you have more than one deferred LGPS pension, you will have different payroll reference numbers for each pension.

Date of leaving (DOL) LGPS – this is the date you left the employment for this pension or the date you opted out of the LGPS.

Date benefits payable from – this is the date when your pension benefits will be paid to you. If you left the LGPS after 31 March 2014, your benefits will be paid from the State Pension Age (minimum age 65).

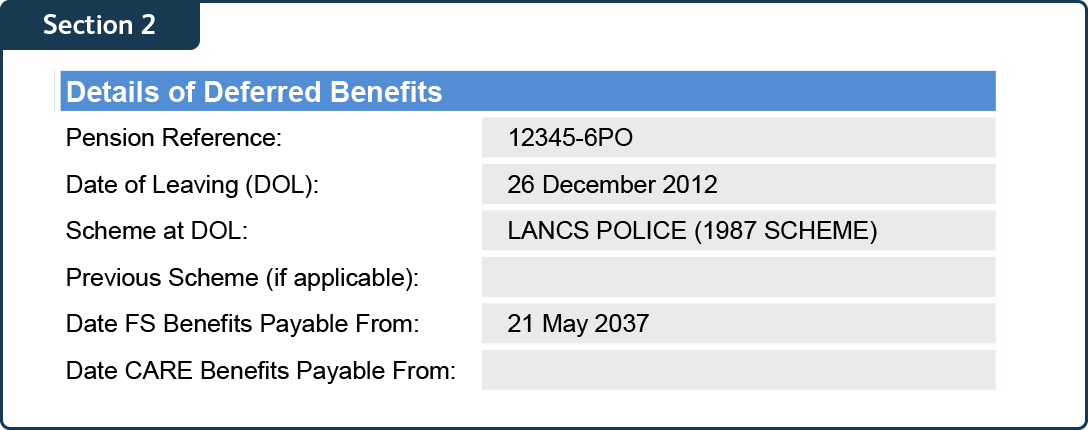

For Police members

Section 2 shows any details relating to your deferred pension.

Pension reference – this is the reference number we use to identify your pension account. If you have more than one deferred Police pension with us, you will have different pension reference numbers for each pension.

Date of leaving (DOL) – this is the date you left the employment for this pension or the date you opted out of the Police Pension Scheme.

Scheme at DOL – this is the scheme you were in at your date of leaving (see more above).

Date FS benefits payable from – this is the date when your final salary (FS) pension benefits will be paid to you. Final salary benefits include any pension benefits that you built up before April 2015.

Date CARE benefits payable from – this is the date when your Career Average Revalued Earnings (CARE) benefits will be paid to you. CARE benefits include any pension benefits that you built up after April 2015.

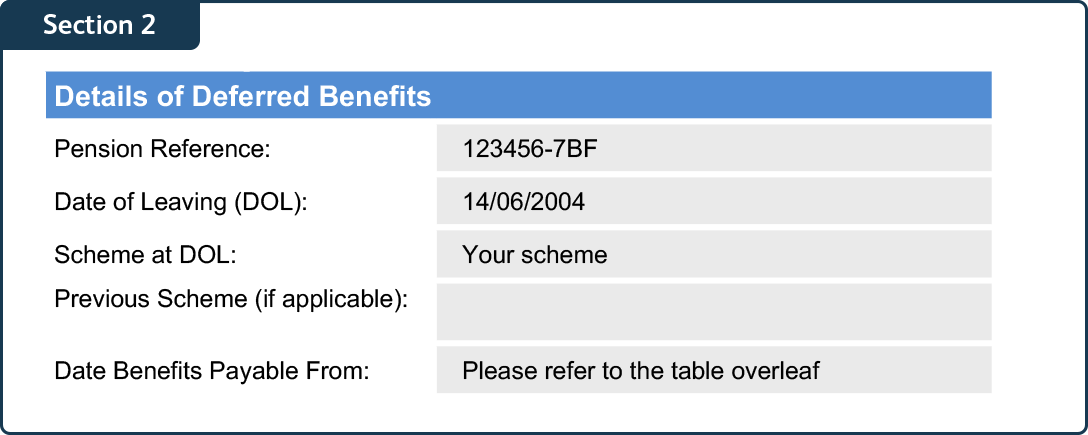

For Firefighter members

Section 2 shows any details relating to your deferred pension.

Pension reference – this is the reference number we use to identify your pension account. If you have more than one deferred Firefighters’ pension with us, you will have different reference numbers for each pension.

Date of leaving (DOL) – this is the date you left the employment for this pension or the date you opted out of the Firefighters’ Pension Scheme.

Scheme at DOL – this is the scheme you were in at your date of leaving (DOL) (see more above).

Date benefits payable from – this is the date when your pension benefits will be paid to you, depending on the scheme year of your deferred pension (as shown in the table below and on your statement).

| Scheme | Deferred benefits payable from the date you turn: |

| Fire 1992 | Age 60 (all members) |

| Fire 2006 | Age 65 (all members) |

| Fire 2015 | The State Pension Age (all members) |

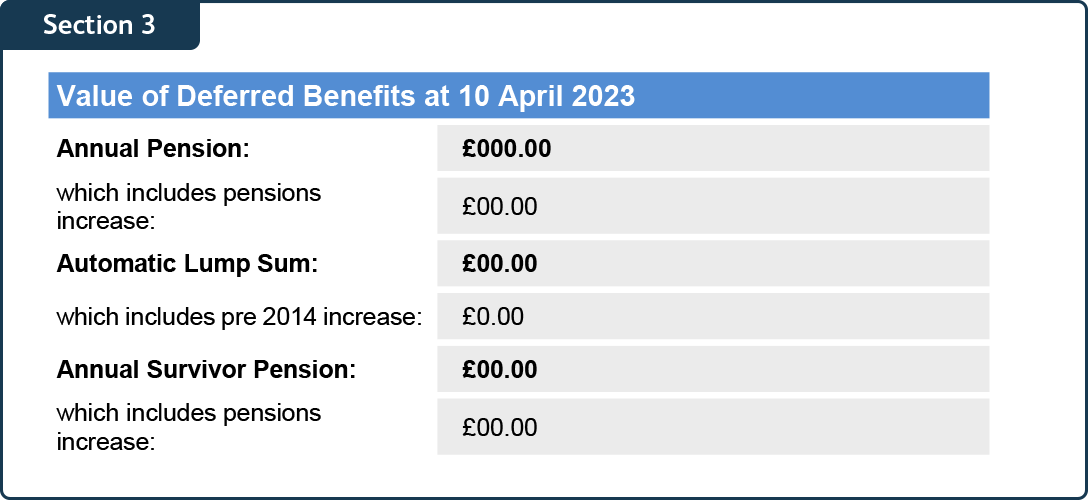

Section 3:

For Local Government members

Section 3 section shows the current value of your deferred benefits, if you were to take out your deferred pension on 10 April 2023.

Each year, the value of your deferred pension is adjusted in line with inflation to keep up with the cost of living, so that your pension is worth more in the future.

Annual pension – this is the total amount of pension you would get yearly (including any cost of living increases), if you were to take out your deferred pension on 10 April 2023.

Automatic lump sum – this is the value of your automatic tax-free cash lump sum, if you were a member of the LGPS before 31 March 2008.

If you became a member of the LGPS after 1 April 2008, you will not have built up an automatic lump sum and this figure will show as zero. However, you will have the option to swap part of your annual pension for a tax-free cash lump sum when you retire.

Annual survivor pension – this is the amount of yearly pension your spouse, civil partner or eligible cohabiting would get after you die, if you were to take out your deferred pension on 10 April 2023. This would be paid to them for the rest of their life.

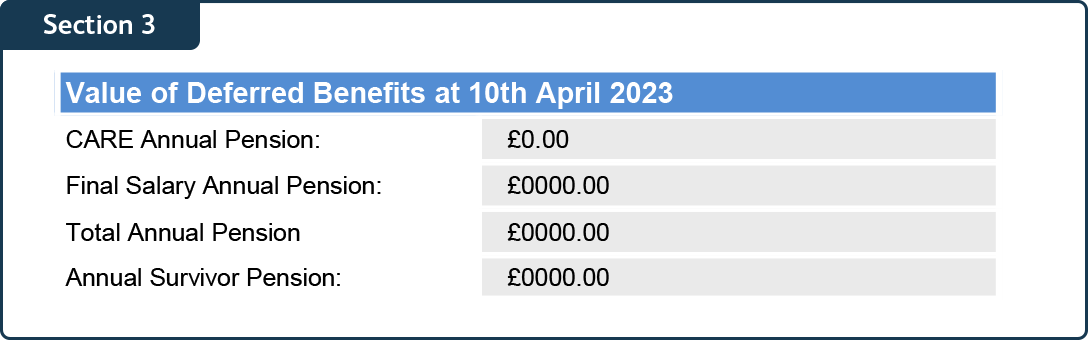

For Police & Firefighter members

Section 3 shows the current value of your deferred benefits if you were to take out your deferred pension on 10 April 2023.

Each year, the value of your deferred pension is adjusted in line with inflation to keep up with the cost of living, so that your pension is worth more in the future.

CARE annual pension – this is the amount of Career Average Revalued Earnings (CARE) pension you would get yearly, if you were to take out your deferred pension on 10 April 2023.

Final salary annual pension – this is the amount of final salary pension you would get yearly, if you were to take out your deferred pension on 10 April 2023.

Total annual pension – this is the total amount of pension you would get yearly (CARE plus final salary pension), if you were to take out your deferred pension on 10 April 2023.

Annual survivor pension – this is the amount of yearly pension your spouse, civil partner, eligible cohabiting partner (Firefighters’ scheme) or declared partner (Police scheme) would get after you die, if you had died on 10 April 2023. This would be paid to them for the rest of their life.