The following information relates to those with at least two years’ Qualifying Service. If you have at least two years’ Qualifying Service and you are an Active Member of the 2015 Scheme you will be able to retire from Normal Pension Age (NPA) or from Normal Minimum Pension Age (NMPA) but this will be subject to Actuarial Reduction with an immediate pension. An Active Member who intends to retire must claim payment of the pension, giving at least one month’s written notice.

Retirement pension

A retirement pension is awarded on retirement after completion of at least two years’ Qualifying Service if you have reached NMPA. As stated above, please note that you will be required to give notice of intent to claim your pension.

Qualifying Service means the calendar length of any continuous period of pensionable service under the 2015 Scheme (not including any gap in service, any career break, or any other period of unpaid leave), plus any previous pensionable service or employment which you have transferred into the 2015 Scheme and, if applicable, your period of pensionable service under the 1987 Scheme or the 2006 Scheme.

Example 1:

A member of a police force was a member of another pension scheme for two calendar years and transfers those benefits into the 2015 Scheme. His/her transferred benefits may not be equivalent to two years’ worth of accrual in the 2015 Scheme. However, his/her Qualifying Service in respect of his/her transferred benefits would remain equal to two years.

Retirement age

Under the 2015 Scheme, NPA is the age at which benefits will come into payment in full without actuarial adjustment. If you leave the police force or opt-out of the 2015 Scheme after NMPA and before NPA with at least two years’ Qualifying service and you do not claim payment of your pension, you will become entitled to a Deferred Pension payable in full when you reach your State Pension Age (SPA). You may claim immediate payment of your Deferred Pension subject to Actuarial Reduction from your SPA. A Deferred Pension may be paid early without Actuarial Reduction if you are permanently medically unfit for any regular employment.

However, you cannot retire with a pension under the 2015 Scheme before you reach NMPA other than on the grounds of ill-health. Alternatively, if you decide to delay your retirement after reaching NPA, you will continue to accrue pension and your pension will be increased on an actuarially neutral basis to take into account its commencement after NPA. If you have not reached NPA and you become permanently medically unfit for the performance of the ordinary duties of a member of the police force while an Active Member of the scheme, your Police Pension Authority (Chief Constable) may require you to retire on the grounds of ill health.

Calculation of your pension under the 2015 Scheme

How your pension builds up in the 2015 Scheme

Your pension builds up over your career to provide you with an

income at retirement.

Pensionable service under the 2015 Scheme

Your pensionable service under the 2015 Scheme includes:

- Your current service as an Active Member during which you have paid pension contributions to the 2015 Scheme or in which you are assumed to receive Pensionable Earnings (e.g. any unpaid period in the first 26 weeks of maternity leave).

- Earlier service as an Active Member in the same force, or in another police force in England and Wales, provided that you did not have a gap in service exceeding 5 years before beginning service under the 2015 Scheme and contributions were not refunded to you in respect of your earlier service.

- Earlier service under the 2015 Scotland Police Pension Scheme or the 2015 Northern Ireland Police Pension Scheme provided you did not have a gap in service exceeding 5 years before beginning service under the 2015 Scheme and contributions were not refunded to you under the 2015 Northern Ireland Police Pension Scheme or the 2015 Scotland Police Pension Scheme.

- Periods of ‘relevant service’ under Section 97 of the Police Act 1996 (this includes appointments to the Inspectorate of Constabulary and certain types of overseas service) during which you have paid contributions under the 2015 Scheme (members contemplating overseas service are recommended to seek advice on the pension position before agreeing to undertake it).

If you have pension benefits in the scheme of a former employer or in a personal pension plan you may be able to transfer them into the 2015 Scheme.

Pensionable earnings

Basic salary, London weighting, increase in pay on temporary promotion and temporary salary count towards Pensionable Earnings. Allowances are not pensionable. For the purposes of calculating earned pension, Pensionable Earnings include:

- The assumed pay for any paid element of any period of maternity leave (and any unpaid maternity leave within the first 26 weeks), paid adoption leave or other paid parental leave provided that you have not opted out of the 2015 Scheme during this period;

- The pay taken to apply to any periods of unpaid leave (sick leave, unpaid maternity leave, unpaid adoption leave, unpaid maternity support leave, unpaid adoption support leave and unpaid parental leave) for which pension contributions have been bought back;

- Pay during any period of ‘relevant service’ as defined under s.97 of the Police Act 1996 for which pension contributions have been paid.

Benefits on retirement

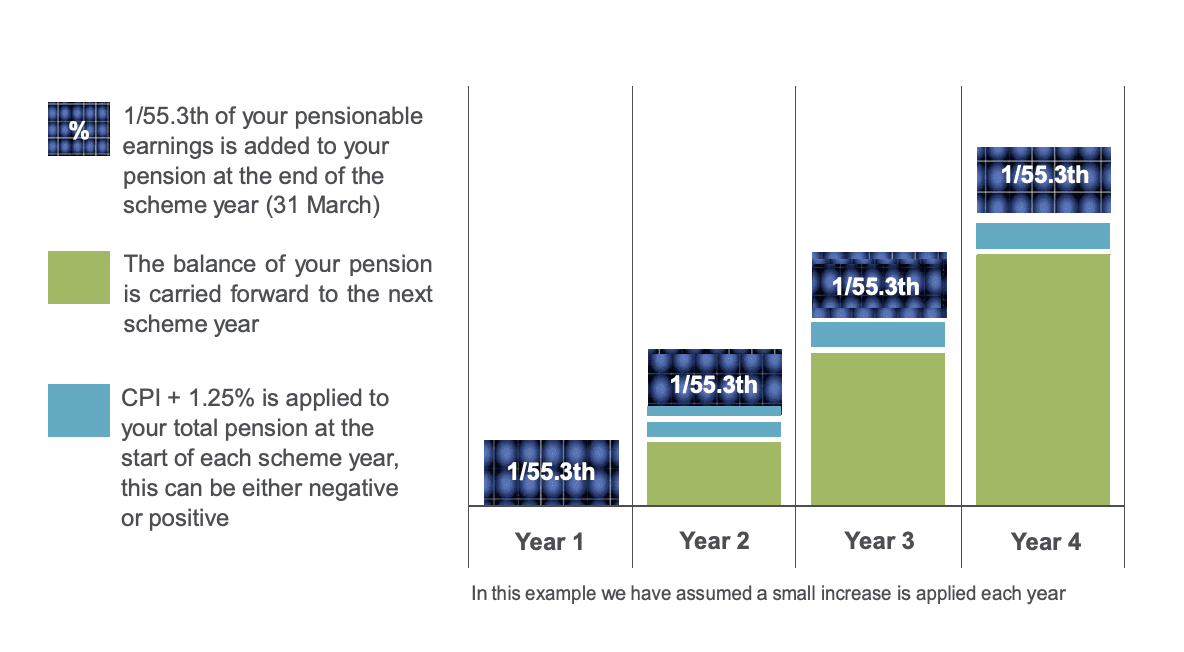

You will receive a pension for life. For each Scheme Year during which you are an Active Member of the 2015 Scheme the amount of earned pension you accrue is 1/55.3th of your Pensionable Earnings for that year. This goes into your pot of earned pension, which builds up each year as more earned pension is added. The amount of accrued earned pension in the pension pot is uprated each year in line with Consumer Price Index (CPI) + 1.25% whilst you are still an Active Member and in line with CPI after you leave the 2015 Scheme. The retirement earned pension payable to you from the 2015 Scheme is calculated based on the amount of accrued earned pension in the pension pot when you retire.

Example 2:

A 30 year old Active Member works full-time and earns £21,000 per year. His/her earned pension accrued over his/her first Scheme Year as an Active Member is calculated as follows:

Year 1

Pensionable Earnings over the year: £21,000

Earned Pension pot at end of Year 1: £379.75 (= £21,000 / 55.3).

Assume that in the next year, the member’s Pensionable Earnings have increased by 1% to £21,210, and that over the last year price inflation (as measured by CPI) increased by 2%. His/her total pension in the second Scheme Year will then be calculated as follows:

Year 2

As s/he has remained an Active Member, his/her accrued earned pension pot from the previous year will increase in line with CPI + 1.25% at the start of the Scheme Year (as CPI growth was 2%, this would result in an increase of 3.25%).

Increased Year 1 earned pension pot: £392.09 (= £379.75 × 1.0325).

His/her accrued earned pension over this year is then calculated as per Year 1. Pensionable Earnings over the year: £21,210 (= £21,000 × 1.01) Addition to earned pension pot: £383.54 (= £21,210 / 55.3).

His/her total earned pension accrued at the end of Year 2 is the sum of the increased Year 1 earned pension pot and the earned pension accrued over the second year: Total earned pension pot at end of Year 2: £775.63 (= £392.09 + £383.54).

This process continues for each Scheme Year during which s/he remains an Active Member (assuming that s/he remains an Active Member for 30 years). The below shows what happens to the earned pension over the last year during which s/he is an Active Member.

Year 30

If his/her Pensionable Earnings continue to grow at 1% per year, and CPI growth stays at 2% per year throughout his/her career his/her total earned pension pot at the end of year 29 will be £20,146.80. Increased Year 29 earned pension pot: £20,801.57 (= £20,146.80 × 1.0325) His/her accrued earned pension in Year 30 will then be calculated as follows:

Pensionable Earnings over the year: £28,024.58 (= £21,000 × 1.0129) Addition to earned pension pot: £506.77 (= £28,024.58 / 55.3).

Total earned pension pot at end of Year 30: £21,308.34 (= £20,801.57 +£506.77) In the April following retirement the total earned pension accrued at retirement will increase in line with CPI + 1.25% to around £22,000 per year. After that, the earned pension will increase in line with CPI throughout the period of payment. At retirement, the member has the option to commute pension for lump sum at a rate of £12 of lump sum for every £1 of pension given up. The commutation lump sum cannot be larger than 25% of the value of the member’s pension.

For example, if the member was to commute 25% of his/her pension income, s/he would be eligible for a lump sum of £63,925.02 (=25% x £21,308.34 x 12) and a revised pension at retirement of £15,981.26 (=75% x £21,308.34).

Part-time working

If you work on a part-time basis the earnings that count towards your pension will be proportionately less than if you worked full-time. If you work full-time or part-time, your pension is accrued in the same way. For each Scheme Year during which you are an Active Member, you accrue 1/55.3th of your Pensionable Earnings for that year. The amount of accrued earned pension in the pension pot at the end of the Scheme Year is then uprated in line with CPI + 1.25% whilst you are still an Active Member and in line with CPI once the pension is put in payment or you are a Deferred Member. The retirement pension payable to you from the 2015 Scheme is calculated based on the amount of accrued earned pension in the pension pot when you retire.

Example 3:

A 30-year-old Active Member works part-time with 40% hours and is paid £8,400 for the first Scheme Year in which s/he was an Active Member (so that his/her full-time equivalent Pensionable Earnings are the same as the Active Member in Example 2). The calculation of this member’s pension will follow the same process as that in Example 2, but using this member’s actual Pensionable Earnings. Assuming that his/her Pensionable Earnings continue to grow by 1% per year and CPI increases by 2% per year, this member will receive a pension of around £8,800 per year on retirement from active service at NPA (note that this is 40% of the pension of the full-time member in Example 2).

At retirement, the member has the option to commute pension for lump sum at a rate of £12 of lump sum for every £1 of pension given up. The commutation lump sum cannot be larger than 25% of the value of the member’s pension.

Deferred pension

You become a Deferred Member if you have at least two years of Qualifying Service and:

- You leave the police force before NMPA, or

- You leave the police force after reaching NMPA, but before reaching your SPA and you do not take a pension, or

- You opt out.

If you rejoin the police force or opt back in within 5 years then you will become an Active Member again. Otherwise you will remain a Deferred Member. Unless you transfer your 2015 Scheme benefits to another pension scheme, or a deferred pension comes into payment early, you will receive a Deferred Pension at your SPA.

A Deferred Pension will be increased in line with CPI under the Pensions (Increase) Act 1971 from the time that you leave the police force or opt out until the date at which your benefits become payable.

Example 4:

A member leaves the police force at age 50 with an accrued earned pension of £20,000 per year. When s/he leaves, his/her accrued earned pension will increase in line with CPI under the Pensions (Increase) Act 1971 and will be payable at his/her SPA). Assume that by the time that s/he reaches SPA his/her Deferred Pension has increased under the Pensions (Increase) Act 1971 by 40%. The member will therefore be able to retire at SPA with a pension of around £28,000 (= £20,000 × 140%). At retirement, the member has the option to commute pension for lump sum at a rate of £12 of lump sum for every £1 of pension given up. The commutation lump sum cannot be larger than 25% of the value of the member’s pension.

Early payment of deferred pension other than on ill-health grounds

If you have left the police force you can choose to have your Deferred Pension paid earlier than your SPA, but it will be reduced for early payment. This is called ‘Actuarial Reduction’ and is to compensate for the fact that the pension will be paid earlier and for a longer period. Your pensions administrator can provide you with more information, but you should be aware that the reduction can be substantial and will be permanent. If you were dismissed or required to resign, you can still claim your Deferred Pension early but you must give at least one month’s written notice to your Police Pension Authority of your intent to claim your pension.